Annuity Present Value PV Formula + Calculator

July 27th, 2021

The present value of an annuity is the present cash value of payments you will receive in the future. This shows the real value of money you will receive in the future. An essential aspect of distinction in this present value of annuity calculator is the timing of payments. If you read on, you can learn what the annuity definition is, what is the present value of annuity as well as how to use this annuity payment calculator.

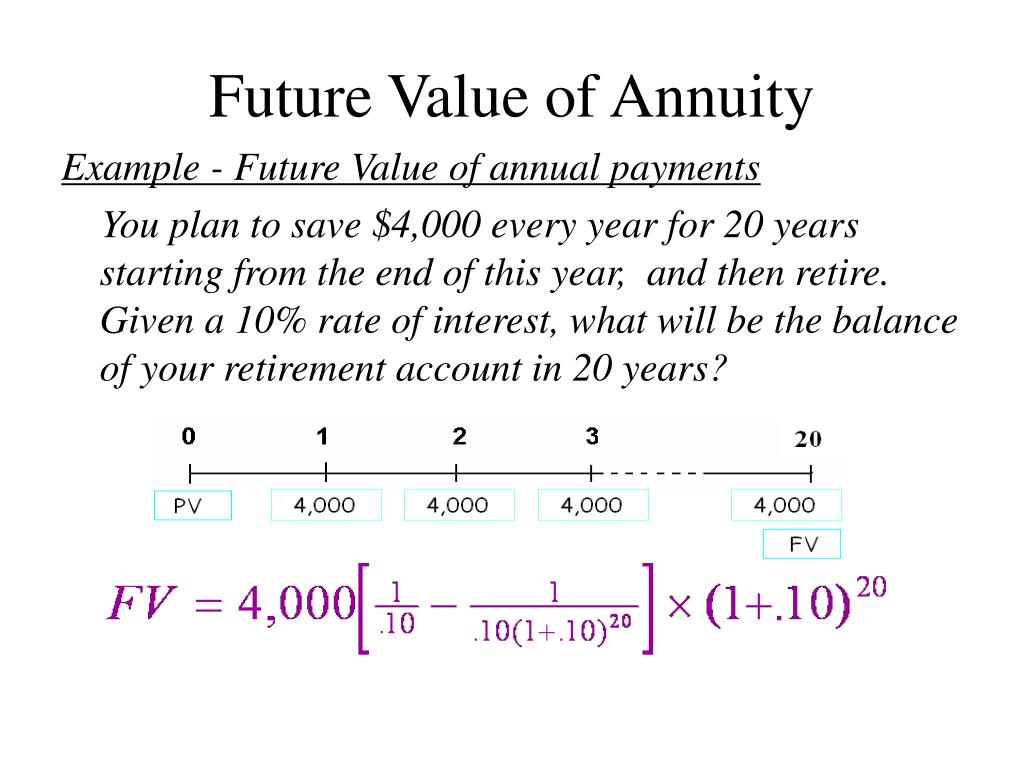

Future Value of Annuity Calculation Example (FV)

By following annuity rules, earnings will accumulate on a tax-deferred basis until withdrawals are ready to be made. In exchange for some or all the money in your pension fund, your lifetime annuity will pay you a regular guaranteed income for life. You will get the option to take up to 25% of your savings (or the amount you’re using to buy an annuity) as a tax-free lump sum. Any tax-free cash taken, will reduce the amount of money left to buy your annuity.

1: Fundamentals of Annuities

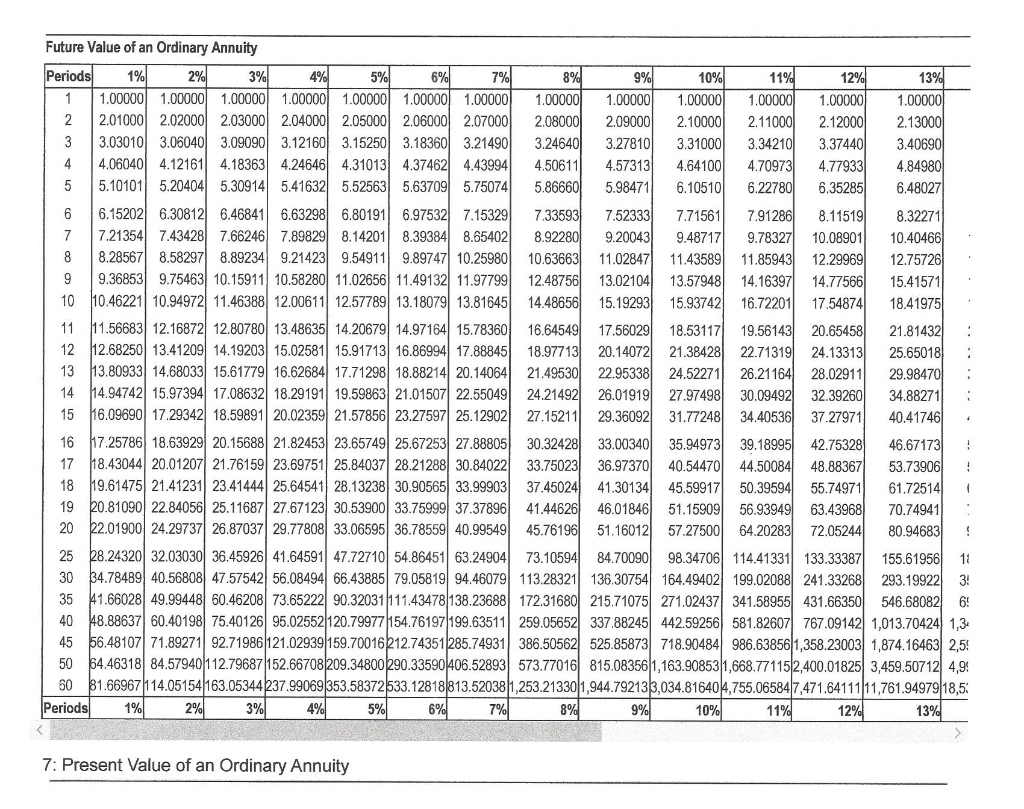

This distinction plays a critical role in formula selection later in this chapter. To help you recognize the difference, the table below summarizes some key words along with common applications in which the annuity may appear. Hefty Fees—The biggest concern with annuities is their hefty cost compared with mutual funds and CDs. Many are sold through agents, whose commission you pay through a considerable upfront sales charge.

Payout Options

Value protection, also known as capital protection, is an alternative death benefit option. It allows you to protect all, or part of the pension fund used to buy your pension annuity. Value protection may return a lump sum to your beneficiaries or estate when you (or if selected, the second annuitant) die.

- The easiest way to understand the difference between these types of annuities is to consider a simple example.

- If your retirement savings are on track to last your lifetime, or even longer, then an annuity might not be necessary.

- This allows them to start receiving distributions that are usually guaranteed for life right away.

- You may also receive more income by choosing to be paid annually rather than monthly.

Annuities can offer guaranteed lifetime income. Here are some of the best providers.

The latter will be tax-free, while the former is subject to the same taxes as ordinary income. The earnings are considered withdrawn first and are therefore subject to taxation. All annuity in advance withdrawals are fully taxable until the account value reaches the principal invested. To see if you are eligible for an enhanced annuity, you can compare lifetime annuity quotes.

Should I wait to get guaranteed income?

Once you reach your annuitization phase you’ll start receiving monthly payments, like a paycheck or a Social Security. Interest earned on a deferred annuity isn’t taxed until you make a withdrawal. The discount rate is a key factor in calculating the present value of an annuity.

For example, $500 to be paid at the end of each of the next five years is a 5-year annuity. To determine the best annuity companies, CNBC Select looked at various U.S.-based annuity providers, considering market share, fees, surrender periods, minimums and availability. We also used customer satisfaction and financial health data from A.M.

The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. Or, put another way, it’s the sum that must be invested now to guarantee a desired payment in the future. Future value, on the other hand, is a measure of how much a series of regular payments will be worth at some point in the future, given a set interest rate. If you’re making regular payments on a mortgage, for example, calculating the future value can help you determine the total cost of the loan.

These have more return potential than fixed annuities and more risk. An ordinary annuity differs from an annuity due by the timing of the payments. Ordinary annuity payments are made at the end of a period, which can be monthly, quarterly, or annually. Annuity due payments, on the other hand, are made at the beginning of the period. You pay your credit card bill at the end of the billing cycle, so it’s an ordinary annuity. However, you pay rent, subscription fees, and insurance premiums in advance.