Best Payroll Software for Small Businesses

They actively track inventory levels, which provides insights into selling patterns and keeps you from running low. With ADP, you can start processing payroll at any time, not just a new quarter or new year. If you’re switching providers, you can ease the transition process by asking for all the necessary forms and information upfront. ADP’s certified, experienced professionals are available to assist with all your payroll software needs. In addition, you can store all your employees’ information in our web-based interface. This drastically reduces the mistakes that can happen when entering data on a repeat basis.

How FreshBooks Payroll Software Works

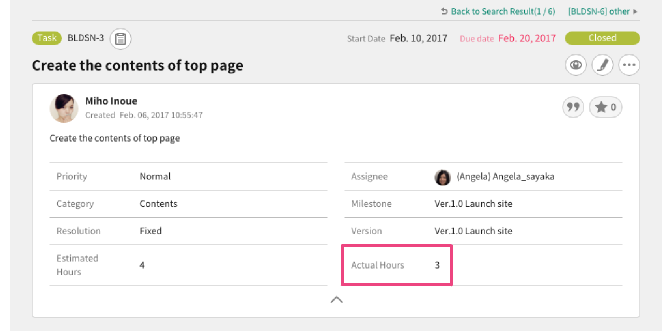

Since I was given the option to send them an invite to input their own information, I would have preferred to only input about half of this data before sending the invite. However, I only had to click a box and click “submit” to send an invite to my employee. Still, the process did not require any technical knowledge and each step was intuitive to complete.

Honest, Objective, Lab-Tested Reviews

You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions. Depending on how long your business has been operating, getting started with a small business accounting service can take anywhere from five minutes to several hours after you sign up for an account. Most offer free trials or a demo account, only charging a monthly subscription fee once you’re ready to commit.

Do I need a bookkeeping service?

With FreshBooks Payroll, you can pay your employees (W-2s) and contractors (1099s) right from your FreshBooks account, saving you time and ensuring accuracy. Plus, instantly see how much you’re spending on payroll, so you’re never in the Bookkeeping for Chiropractors dark. Although InDinero offers scalable plans, they’re not very transparent about what exactly they include in each plan until you talk to a salesperson.

Brainy Advisors: Best for Working Directly with a CPA (Philippines) at a Low Price

- The platform offers a checkbox option to invite the added employee or contractor to fill out the rest of the information themselves.

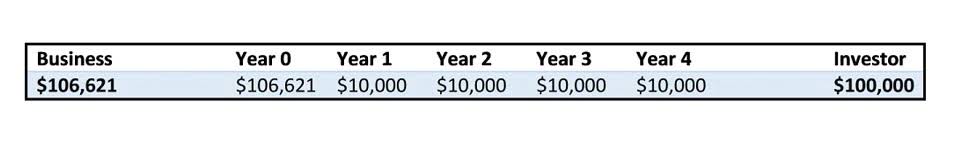

- The cost for these three plans is $200 per month, $400 per month, and $600 per month respectively.

- Since I was given the option to send them an invite to input their own information, I would have preferred to only input about half of this data before sending the invite.

- They also praise Paychex Flex’s customer support for being responsive, patient, supportive and knowledgeable.

- You can also book a call with your bookkeeper (or send them a message) whenever you’d like.

- Payroll services provide the software and other tools that organizations use to prepare and process the wages they pay to their employees and contractors.

Other popular add-ons include payroll processing, invoicing clients, bill payments, and catch-up bookkeeping. QuickBooks Live no longer publishes prices for its bookkeeping service, so you’ll need to get a custom quote. The most recently disclosed starting price before this change was $300 monthly plus an extra setup fee for your first month. We penalized QuickBooks Live heavily in the pricing criterion for its failure to disclose even a starting price. Additionally, 1-800Accountant does not provide invoicing or bill pay services or the bookkeeping and payroll services ability to customize your plan like Brainy does, so it couldn’t get higher marks in these areas.

The dashboard felt cluttered when I landed, but it did offer many tools that I needed at my fingertips. By clicking “run payroll” from the dashboard, I completed a payroll run in just a few clicks. Interface designers clearly worked hard to ensure that data is not overwhelming but is at your fingertips at all times in intuitive-to-find locations.

- Integrated payroll and double-entry accounting support make it an option for small businesses with several employees, though others on this list are better for those purposes.

- You can integrate your accounting data with numerous related apps and functions, like CRM, customer service, and email.

- Think about how you will get money from your bank account to your employees and make it as painless as possible.

- In some cases, these services will include a bookkeeping or accounting software and a virtual team of bookkeepers to manage that system.

- Bench gives you at-a-glance visual reports, which provide you with actionable insight that’ll help grow your small business.

What are the benefits of payroll software?

If you need payment services and payroll software, those cost extra, like they always have with Wave. QuickBooks Live is our top pick for online recording transactions bookkeeping services because it offers cleanup bookkeeping services that vary based on your company’s needs for your first month. This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. RUN by ADP offers full-service payroll, allowing you several options to pay employees, including by check, direct deposit or pay card and processed by phone, web or mobile app.