A Complete Guide to Billable Hours

For example, you could air on the risky side and under-staff, then rely on on-call employees to come in if things get too busy. Conversely, you could be safe and over-staff, then relieve workers if things slow down. A productivity calculation measures the efficiency of how resources are used to produce an item or provide a service. It compares the amount of resources used against the output in order to create a efficiency ratio.

What is the difference between labor rate and efficiency variance?

Contractual obligations ensure both the employer and employee have a clear understanding of the expected working hours. Contracted hours represent the number of hours an employee is obligated to work as stipulated in their employment contract. In this article, we will explore the dynamic between contracted and actual hours and the regulations governing them. Give your restaurant the team management tools they need to be successful. For multi-location restaurants, the Operations Overview tool shows key restaurant metrics for all locations, including hours and revenue, to narrow down which units need improvement. To get even more granular, the Department-Based Budgeting tool makes the right scheduling decisions even more apparent for each area of the business.

What is your current financial priority?

It helps with productivity and work that makes money, and tasks that can’t be billed. When thinking about overtime and breaks, it’s very important to make sure time tracking is correct. This affects how much an employee gets paid for overtime and if they can get benefits. By using time tracking mechanisms, businesses can figure out their billable utilization rate.

Conclusion: Balancing billable and actual hours for agency success

- Providing clients with accurate invoices benefits both you and your client.

- In turn, helping employees stay efficient and keeping labor costs lower.

- Divide the standard labor hours by the actual amount of time worked and multiply by 100.

- The Summary report offers an overview of your tracked time and can be filtered by team, client, project, task, billable, tag, or description.

- By analyzing your restaurants’ earned hours, you can see how well your managers are making adjustments and help them drive better schedule planning, execution, and reaction in the future.

- Non-billable hours are time spent on tasks necessary for your practice but not chargeable to any client.

There is no single formula that will generate the ROI from a new tool. One of our customers is a large food processor that produces packaged vegetable products. They have roughly 200 employees per shift, working 16 equipment driven production lines and approximately 1000 different product SKUs. This formula combines the effects of all the resources used in the production of goods and services (labor, capital, material, etc.) and divides it into the output. The biggest benefit to measuring employee efficiency is in longitudinal reporting, where you calculate efficiency over a period of time. This allows you to identify trends that may impact how you organize staff, or hire and remove employees.

For project managers to be able to identify key tasks, it’s important to maintain a project space that provides full visibility into current project progress and resource allocation. Optimize your billable hours with Productive’s integrated time tracking and financial management features. Traditionally, billable and non-billable hours are tracked in spreadsheets. At the end of the week, it automatically calculates total billable vs non-billable time with accurate reporting. You can focus on productive priorities instead of administrative time tracking headaches. Billable hours mean the time you work on a project for a client for which you can charge money.

In both of these scenarios, it’s worth revisiting your scheduling targets. Labor standards and machine uptime were give weightings of each 30% with the other factors weighted less since those two factors were the primary driver of productivity. Our productivity expert from Easy Metrics, a labor management system, shares an example to illustrate one possible calculation. The end result using the above example was that the client was able to see down to each employee what the productivity level was and then proactively manage and train accordingly. You could also look at labor productivity in terms of individual employee contribution.

Tracking work hours helps freelancers and agencies manage time efficiently, invoice accurately, and analyze productivity. Billable rates can vary between members, clients, or projects, so it’s important to take some time to set them up correctly. Finally, integrating Bill4Time into your practice supports not just individual lawyers but entire teams. The concept of billable hours versus actual hours plays a pivotal role in defining both the economic health and operational efficiency of law firms. By tracking the number of hours worked, employers can ensure that they pay employees for the exact amount of time they have worked. When employees are not bringing in bucks for their time working, it can be difficult to accurately measure their performance.

No matter if your teams work on-site or remotely, conference calls are the staple of any team. They’re quick and convenient for everyone taking part, especially when there isn’t any screen sharing involved (and you don’t have the time to set up an elaborate lessen the burden video … Billable hours are a very important measure of productivity in many industries. Billing practices and accuracy are crucial to make sure hours are worked for clients, etc. This metric helps evaluate how much of your work directly generates revenue.

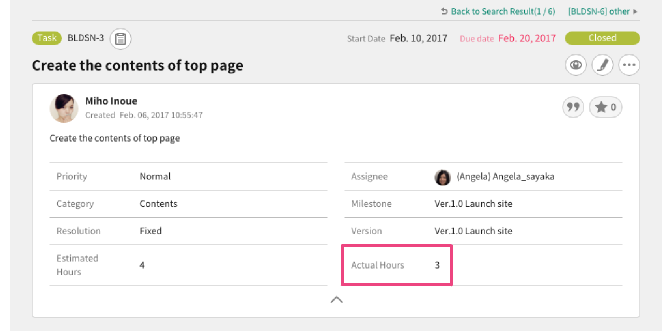

As a result, it gives a clear overview of the use of billable hours from a pay rate per hour perspective. Good time tracking is at the heart of billing practices and improving productivity in a company. It helps make sure billing is correct by tracking hours worked for clients on projects that make money. This difference is very important in figuring out an employee’s use of billable hours. Figuring out actual hours worked includes all hours worked for clients on work and projects that make money. Knowing the rate for billable hours is very important to look at billing practices.

Tracking billing time accurately creates transparent billing processes and helps law firms measure individual and overall performance. You can also calculate billable hours by using the SUMPRODUCT function. You can calculate billable hours in Excel by using the SUM function.