Current Local Time in New York City, United States New York: Date, time zone, time difference & time change

May 17th, 2021

Calculating the number of billable hours is important, especially for freelancers and service-based businesses. The chart makes it easy to convert the time spent on various tasks into billable units and accurately charge for every minute of work. For an in-depth look at your time tracked, Toggl Track also generates Detailed reports with individual time entries. After you set up your projects and tasks, you can start creating time estimates to track project and task progress. Honesty and transparency around billable hours can also help build client trust.

How to calculate billable hours in Excel?

This basic procedure improves the billing practices, increases billing accuracy, etc. This formula helps ensure that your rate covers your costs and meets your financial objectives. An example of a billable hour is the time a consultant spends in a meeting discussing project strategies with a client, drafting a project plan, or executing it. Tracking hours spent on client projects helps them get their pricing right, manage project scopes effectively, and allocate resources efficiently.

Connect With Agency Peers

- Tracking the number of hours worked can help ensure that clients are billed accurately for the time spent on their projects and can avoid misunderstandings or overcharges.

- By tracking the number of hours worked, individuals and teams can better manage their time and ensure that they are using it effectively.

- There’s a common misunderstanding about the difference between hours worked for clients (billable hours) and other work (non-billable overhead).

- An agency needs to keep a balance between hours worked for clients, tasks that can’t be billed and operational overhead for overall success.

The pay rate per hour is figured out based on work that makes money, hours worked for clients, and projects that can be billed. It also takes into account tasks that can’t be billed and other work. A manager’s earned hours performance is determined by their actual hours-to-earned hours variance. The variance is derived from calculating actual hours (how many hours the employees worked) – minus – earned hours (how many hours they should have worked given the actual sales performance). The resulting (+/-) variance indicates how well a manager reacted to real-time restaurant sales against their employee schedule.

How confident are you in your long term financial plan?

Insights into building businesses better, from hiring to profitability (and everything in between). Use a Billing Increment Chart or Billable Hours Chart to convert minutes into tenths of an hour for precise billing. It also offers a clear view of project profitability and productivity. To view and manage past invoices, click on “Invoices” on the left side of the screen.

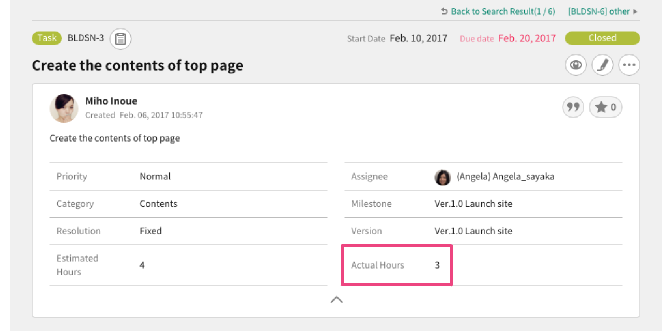

This software not only helps offices keep track of billable hours but also makes other useful tasks easier, like productivity analysis, costing, reports, invoicing, and accounting. But knowing how to effectively track them can be a tricky business. Billable hours are lucrative for firms—sometimes, it’s necessary for employees to reach ambitious quotas. Effective tools for tracking time are important for keeping the balance between hours worked for clients and other work. It makes sure each hour spent on projects that can be billed is accounted for and paid correctly. Calculating the correct pay rate per hour also plays a role in figuring out your actual hours.

At this stage, it’s also important to understand the difference between what’s billable and what’s not. Access agency-related Slack channels, exchange business insights, and join in on members-only live sessions. Makerstreet is an Amsterdam-based collective of agencies with over 300 employees in four offices. The legal market and your practice needs will evolve, so you will need to regularly review your billing structure. Stay up-to-date on changes in market demand, legal technology advancements, and your own practice’s growth or specialization changes.

They give a good structure for tracking projects that can be billed. This makes sure billing is correct and keeps track of total hours worked. By comparing estimated project performance with actuals, you can make more accurate assumptions and set reliable contract terms with the client.

Businesses often compare billable hours (chargeable to clients) to is minority interest an asset or a liability to assess productivity and profitability, reflected through metrics like the billable-to-non-billable ratio. Employers should ensure that employees understand the difference between contracted hours — the hours they are obliged to work — and actual hours — the hours they truly work. Measuring employees’ hours worked is critical for multiple aspects of business operations. It allows for accurate payroll processing, ensures compliance with labour laws, and helps assess overall productivity. If you find that actual hours exceed your earned hours week-after-week, it could be a sign that your restaurant’s forecasting is off.

Without monitoring actual hours, an employer might unintentionally breach such legal standards, risking penalties and legal challenges. When hours worked are not correctly recorded, it can result in underpayment or overpayment, which have significant implications for employee satisfaction and the company’s financial integrity. Regularly working significantly over contracted hours can sometimes lead to legal issues or require contract adjustments to reflect the true work pattern. For instance, an individual might work fewer hours due to sickness or more through overtime, but contracted hours remain a constant benchmark.